The Financial Independence Community is quickly gaining ground as being one of the best sources for not only financial, but life, advice. They are proving that early retirement is possible and their strategies aren’t just for those of us in our 30’s and 40’s looking to mend our financial mistakes. They have reached a new audience, a younger audience. Today, it is possible for a younger generation to take hold of their finances and their lives. The information provided reaches far beyond money and is instilling a different level of hard work. Forget about the 9-5. It’s all about optimizing your money, your time and your life through creative side hustles, simple investment strategies, and living an intentional life.

Today I am more than excited to introduce you to a young man who was fortunate enough to find the path to financial independence at an early age. At the ripe old age of 22 Cody Berman has already accomplished so much to be proud of. Not only has he found ways to optimize his finances through hard work, internships, scholarships, creative side hustles, and house hacks. But he has learned to optimize his life through travel, experiences and deep relationships. He has founded a company, created a blog AND a podcast, excelled in his financial analyst career, and most importantly helped so many others to reach their goals as well.

We were very honored to meet this legend in the FI world at FinCon this year in Orlando and even more honored to now call him our friend. He proves that this generation isn’t just about finding the easy way out to retire early, but rather about working hard early to achieve a life you can be proud of, a life that you love to live. Today he shares with us his views on finding the path to financial independence early and how the skills he learned can be applied to any age.

First of all, thank you to Jimmy and Jenny for allowing me to share my thoughts and insights with all you readers. After exchanging comments, tweets and other social media banter with these two, I finally got to meet both of them in person at FinCon in Orlando, Florida! Not much to your surprise, Jimmy and Jenny are just as awesome in person as they seem online 🙂

So who am I? My name is Cody Berman and I’m a 22-year-old entrepreneur, life optimizer, and seeker of personal growth. My one overarching goal is to live the most intentional, meaningful life that I possibly can. Fortunately, I’m at the perfect age to make this all happen! I don’t have a mortgage, I don’t have kids, I don’t have student loans, I don’t have consumer debt, and I’ve been fortunate enough to avoid any serious financial mistakes.

Whether you’re 10 years old or 80 years and reading this article, I’m sure that either you or someone close to you can benefit from the information I’m about to share. Let’s dive into all the advantages of discovering financial independence (FI) at an early age.

Compound Interest

We’ve all heard the studies about how you should start investing as early as possible, but how much does this actually affect your investment portfolio in the long run. Short answer: A LOT!

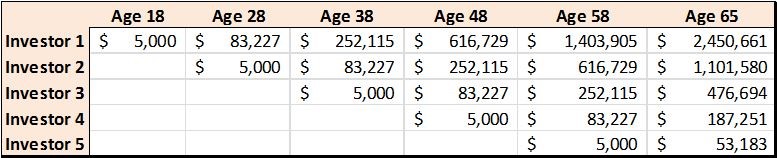

The following Excel chart highlights five different investment scenarios with the following assumptions:

- $5,000 is invested each year

- The market returns 8% every year (on average)

- Investor 1 starts contributing at Age 18 and invests $5,000 per year.

- Investor 2 starts contributing at Age 28 and contributes $5,000 per year.

- Investor 3 starts contributing at Age 38 and contributes $5,000 per year.

- Investor 4 starts contributing at Age 48 and contributes $5,000 per year.

- Investor 4 starts contributing at Age 58 and contributes $5,000 per year.

Investor 1’s net worth at age 65 more than DOUBLES Investor 2’s, QUINTUPLES Investor 3’s, 13Xs Investor 4’s, and 46Xs Investor 5’s!!!

As you can clearly see, the earlier you invest, the greater advantage you have. If I continue to contribute $5,000 (or more) each year to my investment accounts, it would be near-impossible for a 50-year-old just starting out to catch up… it’s just simple math!

You’re truly never too young to start investing. If you have a son, daughter, niece, nephew, or anyone else close to you, get them set up with a Roth IRA ASAP!

Hacking the Cost of College

The cost of college in America is getting ridiculous. Students are coming out buried in five or six figures of student loan debt! Often times, this debt takes decades to eliminate and impedes the borrower’s path to financial independence. I’m here to show you that there is a different way. If you choose to go to college, you can succeed without submerging yourself into a pool of debt!

Although I’ve written extensively on this topic and even created what I call The Ultimate College Guide, I’ll quickly highlight the big picture items that can drastically reduce the cost of college.

- Scholarships – Want to earn hundreds of dollars per hour and drastically reduce the cost of college? Scholarships are the way to go. In my experience, approximately 80% of scholarship prompts can be answered with 5 or 6 template essays. Once you build your templates, submitting a scholarship essay only takes ~30 minutes of tweaking and editing. You can literally spend a couple dozen hours filling out scholarships and earn thousands of dollars in return!

- Community College – Despite what you may have heard, employers don’t care where you spent your first two years of school. The only thing they look at is the final destination! You can save thousands of dollars by attending a community college for the first two years of your college education.

- AP and CLEP Exams – These exams are such powerful tools for cutting college costs, but unfortunately most people find out about them too late. AP and CLEP exams are subject-specific tests that, with a passing score, can potentially replace college courses and save thousands of dollars.

Fortunately, I was able to graduate college without any student loans by taking advantage of some of these strategies. This has placed me far ahead of my peers on the road to financial independence. If you know someone who’s taking the college route, make sure to take advantage of these tools and avoid thousands of dollars in debt!

“Live Like a College Kid”

I genuinely think this is the greatest advantage on my path to financial independence. At 22, I have so much freedom to fail! If I put all my effort into a venture and it fails miserably, oh well — on to the next one! Every additional failure allows me to learn, grow and gain new skills. After a while, my skill collecting is bound to pay off!

One of the only reasons why I have so much freedom and flexibility is because I avoided lifestyle inflation. In my current situation, I can live on $1,000 per month. I understand that may seem insane to many of you, but this intentional decision grants me so much flexibility!

I don’t mind continuing to live like a “college kid” in order to chase my entrepreneurial dreams. Do I really need to live in the fancy apartment and lease the newest car only to trap myself in the endless cycle called The Hamster Wheel? HELL NO! I want to explore my passions, chase my dreams, and shoot for the stars.

If I don’t earn $1,000 in the first few months from my entrepreneurial ventures, I can support myself through the sharing economy with services like Uber, Lyft, Postmates, Rover, Upwork and so many more! However, imagine my lifestyle cost $5,000 per month… good luck earning that through the sharing economy.

These are my grind years. I have no shame – I’ll sleep on a couch, floor, or wherever to make ends meet. At this point in my life, I don’t need nice things. I don’t need a huge house, I don’t need a flashy car, I don’t need expensive clothes and possessions. I’m after an asset that’s far more valuable than any of those things: time.

Key Takeaways

If you can manage to leave college debt-free and avoid lifestyle inflation upon graduation, the world is yours! The barriers between you and your dreams are so low you could step over them.

I know I’ve written this post from a 22-year-old’s point of view, but that shouldn’t deter you from taking advantage of these same strategies in your own financial journey. It’s never too late to take control of your finances.

However, its no secret that starting young has massive advantages. So, if you found this post valuable, please share with your son, daughter, nieces, nephews, or anyone who might benefit from this information. I wish you all the best of luck in your journey to financial independence.

Author’s Bio: Cody is a 22-year-old entrepreneur and life optimizer. He runs the personal finance blog Fly to FI and hosts the FIRE Below Zero podcast. Aside from financial independence, Cody is also passionate about fitness, travel, and relationships. He aims to live a life of intentionality and purpose and to spread financial literacy to all who will listen.

Author’s Bio: Cody is a 22-year-old entrepreneur and life optimizer. He runs the personal finance blog Fly to FI and hosts the FIRE Below Zero podcast. Aside from financial independence, Cody is also passionate about fitness, travel, and relationships. He aims to live a life of intentionality and purpose and to spread financial literacy to all who will listen.

Want more from Living Life Loving Us? Sign up below for free updates. No spam just friendly ‘hellos’ and extra tips!